The Biggest Threat To Our Freedom

Central Bank Digital Currencies are already here, and they present the biggest threat to our freedom. Let's look closely to understand how this works.

Самая большая угроза нашей свободе

Цифровые валюты Центрального банка уже здесь, и они представляют самую большую угрозу нашей свободе. Давайте посмотрим внимательно, чтобы понять, как это работает.

Set Your Pulse: Take a breath. Release the tension in your body. Place attention on your physical heart. Breathe slowly into the area for 60 seconds, focusing on feeling a sense of ease. Click here to learn why we suggest this.

During the Freedom Convoy, Justin Trudeau’s government decided they were going to freeze the bank accounts of peaceful protestors as a means to deter and stop protests that, quite frankly, were making the Canadian government look bad in the eyes of many.

As many as 280 bank accounts were frozen during that time. Those tax paying citizens who disapproved of government policies and wanted to peacefully say something about it lost access to their funds in a matter of hours.

The truth is, this type of action by government could become much more common in the near future, and they could do it much more quickly.

In fact, with what’s coming, governments could have the power to stop you from buying anything without their permission. They could even monitor and track everything you buy, including who you buy it from. This would all be done through Central Bank Digital Currencies (CBDCs).

In this piece I’ll break down what CBDCs are, ways in which they can be used nefariously, and how we can stop them.

Установите свой пульс: сделайте вдох. Сбросьте напряжение в теле. Направьте внимание на свое физическое сердце. Медленно дышите в эту область в течение 60 секунд, сосредоточившись на ощущении легкости. Нажмите здесь, чтобы узнать, почему мы предлагаем это.

Во время конвоя свободы правительство Джастина Трюдо решило заморозить банковские счета мирных демонстрантов в качестве средства сдерживания и прекращения протестов, которые, откровенно говоря, выставляли канадское правительство в плохом свете в глазах многих.

За это время было заморожено 280 банковских счетов. Те плательщики налогов, которые не одобряли политику правительства и хотели мирно что-то сказать об этом, в считанные часы потеряли доступ к своим средствам.

Правда в том, что такого рода действия правительства могут стать гораздо более распространенными в ближайшем будущем, и они могут делать это намного быстрее.

На самом деле, с учетом того, что грядет, правительства могут иметь право запретить вам покупать что-либо без их разрешения. Они могли бы даже контролировать и отслеживать все, что вы покупаете, включая то, у кого вы это покупаете. Все это будет сделано с помощью цифровых валют центрального банка (CBDC).

В этой части я расскажу, что такое CBDC, способы их нечестного использования и как мы можем их остановить.

A Quick Overview of CBDCs

A Central Bank Digital Currency, also known as a CBDC, is a new form of digital money similar to a cryptocurrency. But unlike cryptocurrencies which are decentralized and private, CBDCs are not at all. They are instead the total opposite of cryptocurrency.

CBDCs are completely owned and controlled by governments. Meaning governments would hold your wallet, your money, and have access to all of your banking information. This would include information on every transaction in your daily life. It’s ultimate centralization.

With cryptocurrencies, governments can’t track how much you have, where you spend your money, or who you give it to. Plus they are decentralized, effectively pulling power away from central banks who have been using debt to control and enslave entire populations for decades.

With upcoming CBDCs, governments would enjoy more secrecy, and be able to control their population more than they currently do. CBDCs would also be easier to tax, since hiding any money from the government would be impossible.

Remember, central banks ARE the problem, and have been for decades.

Crypto was created to stop this problem, yet they have gotten a bad rep because they don’t serve the interests of powerful people.

Here is what NSA surveillance whistleblower Edward Snowden had to say about CBDCs:

"A CBDC is something closer to being a perversion of cryptocurrency, or at least of the founding principles and protocols of cryptocurrency—a cryptofascist currency, an evil twin entered into the ledgers on Opposite Day, expressly designed to deny its users the basic ownership of their money and to install the State at the mediating center of every transaction.”

In short CBDCs could represent the largest shift in the way money operates in human history, and it won’t benefit the common person.

Already Being Deployed

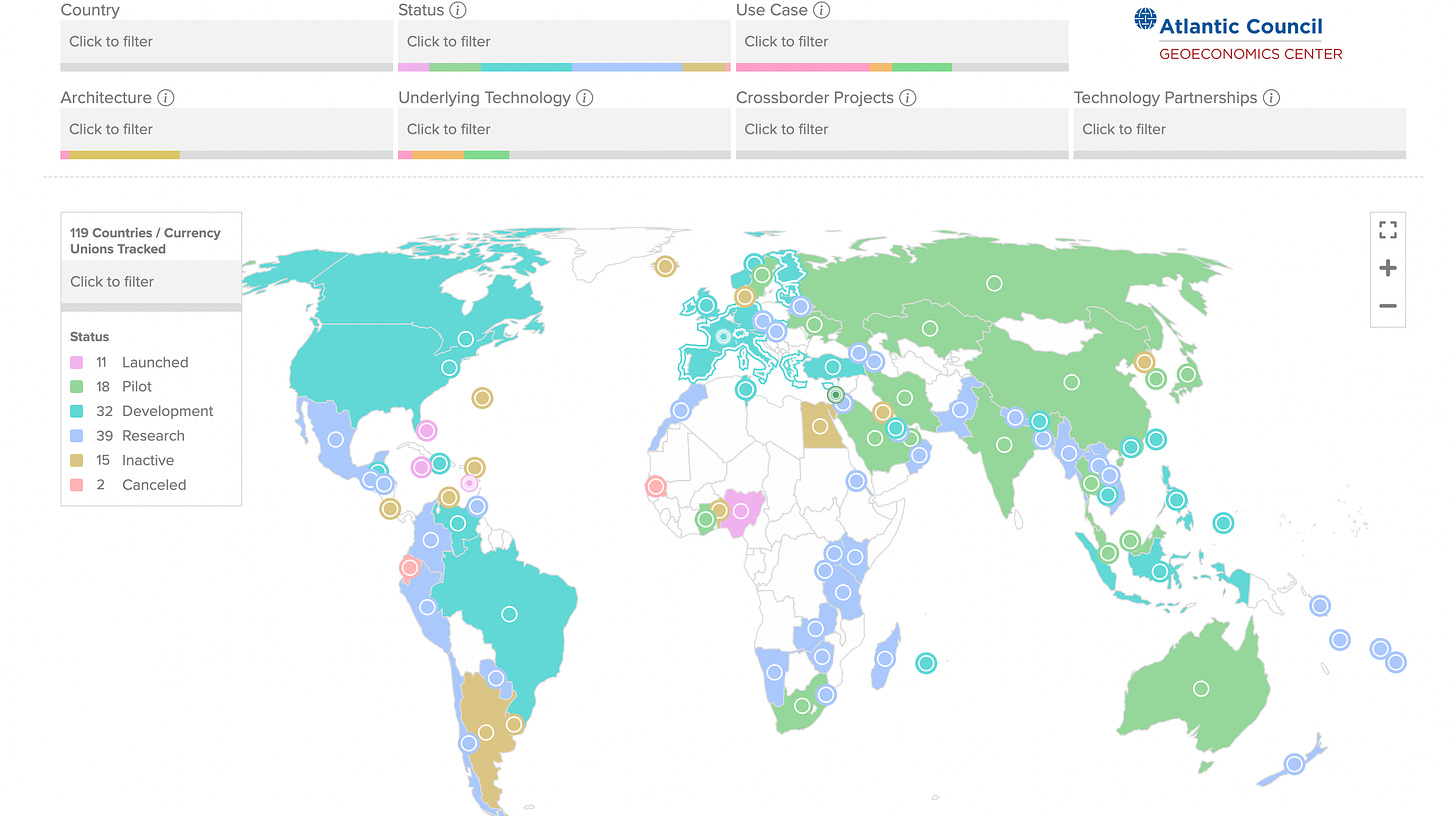

CBDCs are already being deployed in several countries around the world.

During November of 2022 in the US, the Federal Reserve held a 12-week trial of its own CBDC. It was supported by major financial institutions including MasterCard, Citibank, HSBC, and Wells Fargo.

According to the Atlantic Council tracker, CBDCs have been launched in 11 countries around the world already, and 114 countries are at some stage of deploying them.

Some of these countries include China, Australia, India, Canada, and Brazil. Nations that account for more than 95% of the world's total GDP.

One could imagine that the messaging to ease people into accepting such levels of government oversight begin with the discussion of ‘safety,’ including stopping ‘money laundering.’ A classic form of rhetoric used to employ greater surveillance for decades.

On Oct 26th 2022, Netherlands Finance Minister Sigrid Kaag, who serves as the co-chair of the Global Action Group at the World Economic Forum (WEF), submitted a new set of laws to Dutch parliament that would force banks to monitor all transactions over €100. Currently, only transactions over €10,000 are flagged.

This new bill would give the Dutch government access to an incredible amount of personal data on citizens that it would be able access at anytime without any kind of warrant.

The claim is monitoring these transaction will help curb money laundering and terrorist financing. But at what cost to citizen privacy is this being done? Or is there another agenda all together?

Similar new laws are being debated in the US as well. The Biden administration proposed a bill that would monitor US citizens transactions over $600. This has since backed off.

But the administration is still pushing for third party payment providers, like Paypal, to report total transactions over $600 to the IRS. Effectively making these companies private investigators on behalf of the US government.

With these new laws being put in place to monitor the transactions of the average citizen, it could ease messaging into entire infrastructures that can monitor people’s every transaction, and control spending habits ‘for good reasons.’

This is where CBDCs come in.

The Rhetoric: ‘Safety’ and ‘Inclusion’

Before we get to how these could be used nefariously, let’s look at the similar messaging coming from key institutions about CBDCs.

In the USA Federal Reserve says:

“a CBDC would be the safest digital asset available to the general public, with no associated credit or liquidity risk. […] and could improve on an already safeand efficient U.S. domestic payments system.”

The International Monetary Fund also says:

“CBDCs are designed prudently, they can potentially offer more resilience, more safety, greater availability, and lower costs than private forms of digital money. That is clearly the case when compared to unbacked crypto assets that are inherently volatile. And even the better managed and regulated stablecoins may not be quite a match against a stable and well‑designed central bank digital currency.”

The World Economic Forum even wrote a whole piece called ‘4 ways to ensure Central Bank Digital Currencies promote financial inclusion‘

According to those with all the power, CBDCs will provide more safety and inclusion. These are themes that we can all get behind, but as per usual, we should be highly skeptical about governments stating this given their track record.

Recall, anything can be presented as good or bad. But it’s really about how we observe history, patterns, and the direction our society is headed.

Social media was presented as a place to connect with friends. It promised to make the world a ‘small place’ by connecting people all around the world in meaningful ways.

Sure, this happened to some extent, but Big Tech also became a tool for control. A tool to surveil and spread propaganda to the masses. It censored truthful information and led to the dissemination of government misinformation that tore families and communities apart during COVID.

Tools can be useful, but the people behind them, including their thinking and worldview, matters. This is why I believe that in order to truly change our world we must look to the depths of what drives our worldview.

CBDCs Are About Control

The worldview of our leaders seems to be grounded in control and domination, not the thrivability of people.

An article in Forbes summed up many people’s concerns in a single headline stating very simply “Central Bank Digital Currencies are About Control.”

Источник: https://www.thepulse.one/p/the-biggest-threat-to-our-freedom